Japan Power Futures for Price Risk Management

(Provisional translation)

(English ver.) 2024-09-12

Wholesale electricity markets at Japan Electric Power Exchange (JEPX) have now become indispensable for the power industry in Japan. Since the electricity retail market was fully deregulated, the wholesale electricity markets have expanded rapidly with increasing participation by electricity retailers that are newly entering the business. Furthermore, Japan power futures trading started in 2019 as a new method for electricity trading. Although the term “futures trading” may sound too complicated, some electricity businesses procure electricity at a stable cost by utilizing this method wisely to reduce risks associated with price fluctuations. This article highlights electricity futures trading, which may be beneficial not only for electricity businesses but also for corporate users consuming a large amount of electricity.

Why can power futures trading serve as a hedging tool for price risk management?

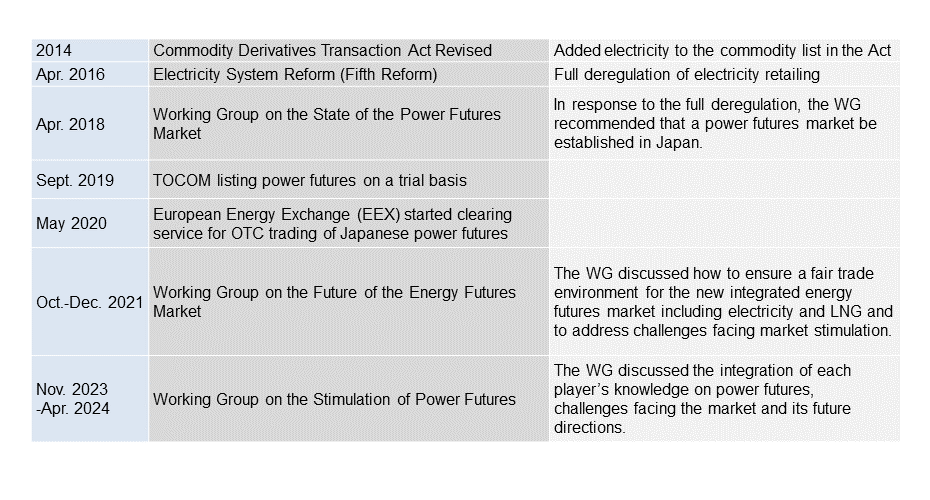

In 2018, the Working Group on the State of the Power Futures Market discussed a detailed system design for power futures for price risk management. Based on the results of this discussion, Tokyo Commodity Exchange Inc. (TOCOM) listed power futures on a trial basis in September 2019 for the first time in Japan. Following this trial, full-scale operation started in April 2022.

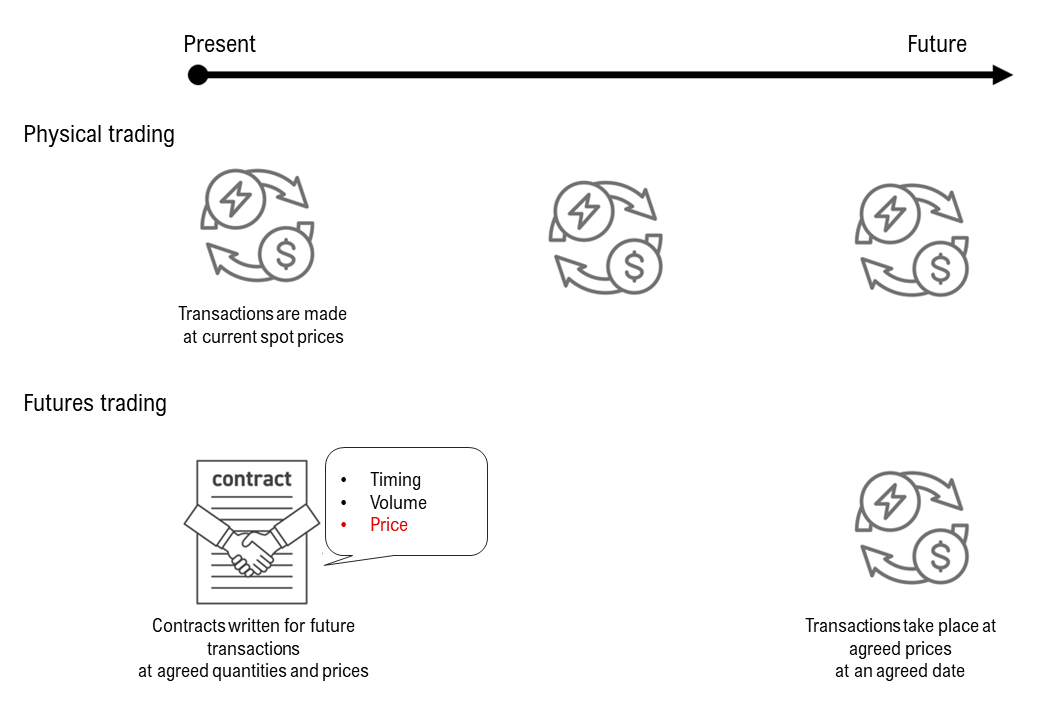

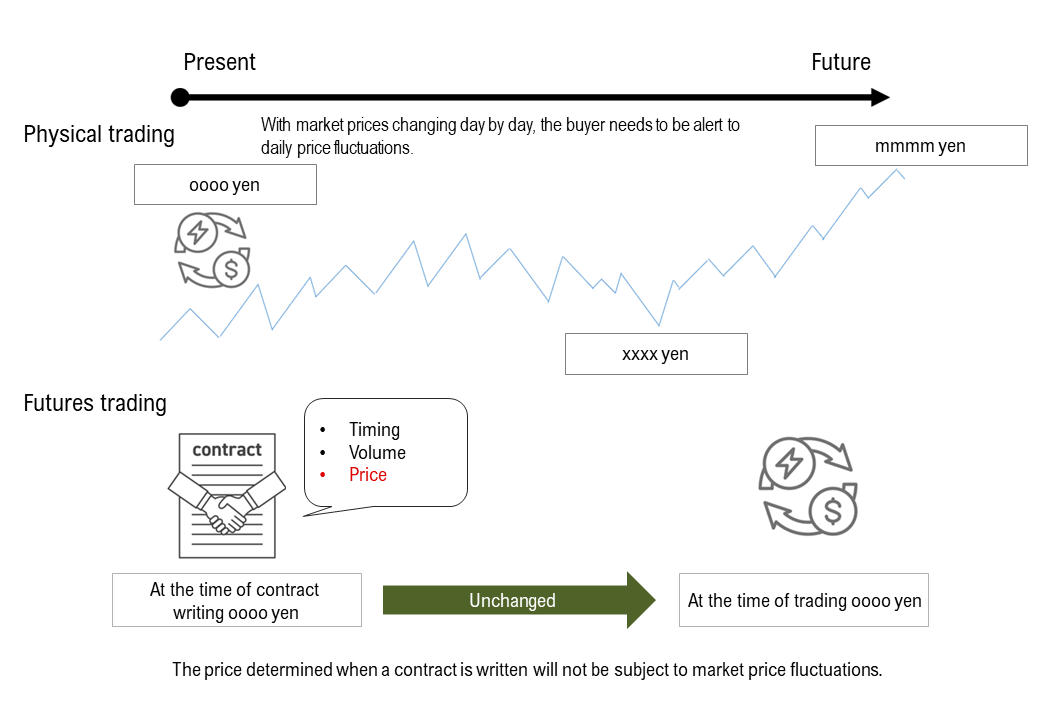

Unlike physical spot transactions, futures trading is a form of trading in which contracts are written at the present point in time for commodities at agreed quantities and prices but traded and paid for at an agreed date in the future.

Thermal power generation has a large share in the power mix in Japan. Oil, coal and LNG (liquefied natural gas) are used for thermal power generation and largely dependent on imports. Their import costs tend to be affected by international situations, and fluctuations in fuel prices have an impact on the electricity market. Furthermore, in summer and winter, when electricity demand is high, electricity prices may become volatile due to potential supply-demand imbalance. Power futures will serve as a hedging tool for price risk management that allows for procurement at pre-determined prices regardless of future price fluctuations.

Hedging by a combination of physicals and futures for price risk management

In fact, quite a few electricity businesses are prudently combining physicals with futures for hedging purposes. Let us take a case below.

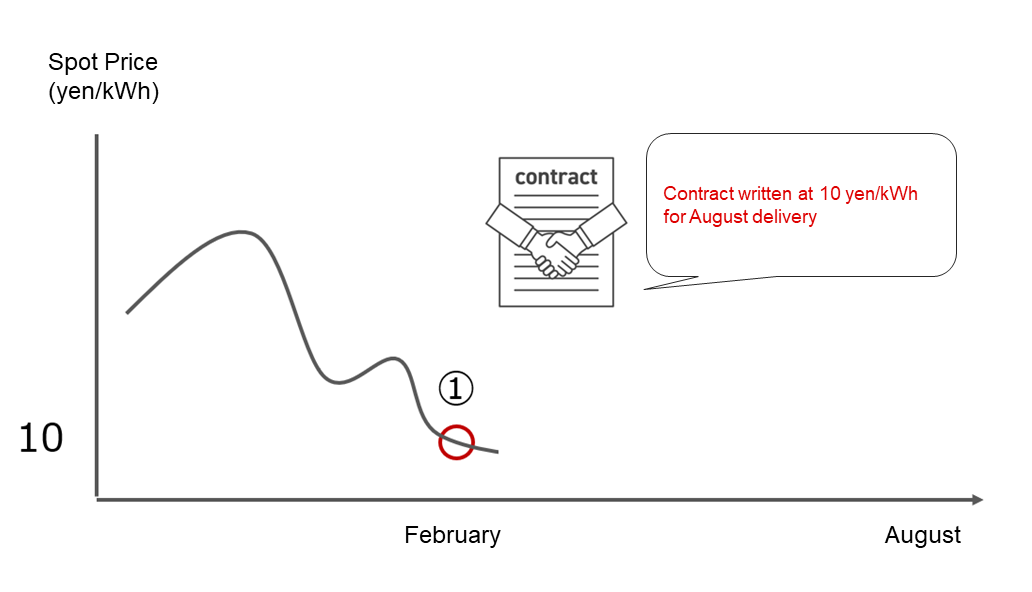

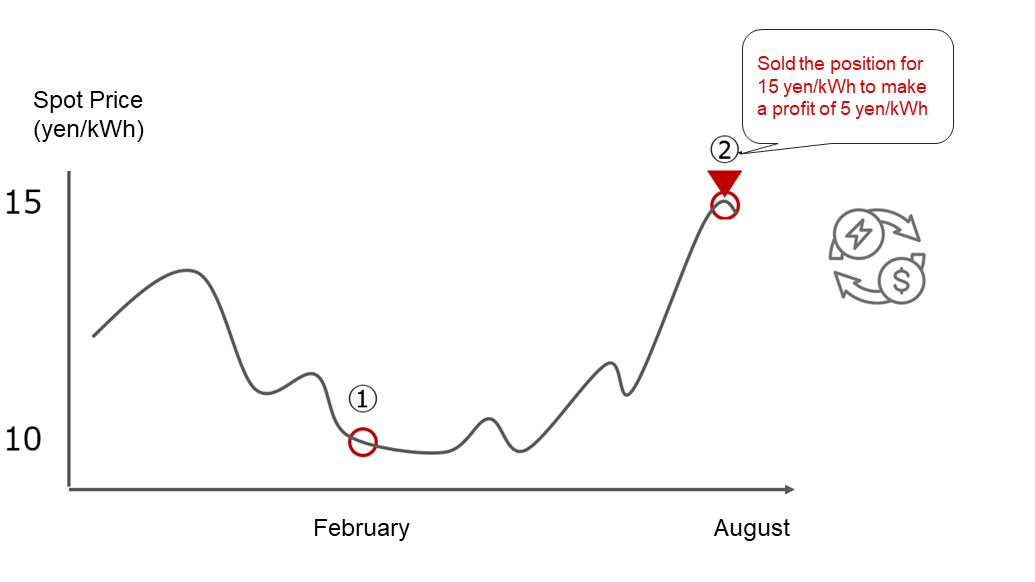

The following graphs show future electricity prices in August of a certain year with the vertical axis indicating price and the horizontal axis indicating time. In February, an electricity retailer (Company A) is formulating a business plan for the next fiscal year starting in April and intends to fix the purchase price of electricity for August, when prices may soar. It has bought electricity for August at 10 yen per kWh through futures trading with a contract written in February. This means that both a seller and buyer exist in the market in February who expect the electricity price to be 10 yen per kWh in August. (See ①)

August electricity prices that buyers and sellers are speculating (Futures for August deliveries) ①

However, the JEPX (Japan Electric Power Exchange) day-ahead spot market realized the average electricity price in August as high as 15 yen per kWh. As futures in the settlement month (August in this case) are designed to be equal to physicals monthly average, Company A settled its position on the last business day of the month and made a profit of 5 yen per kWh.

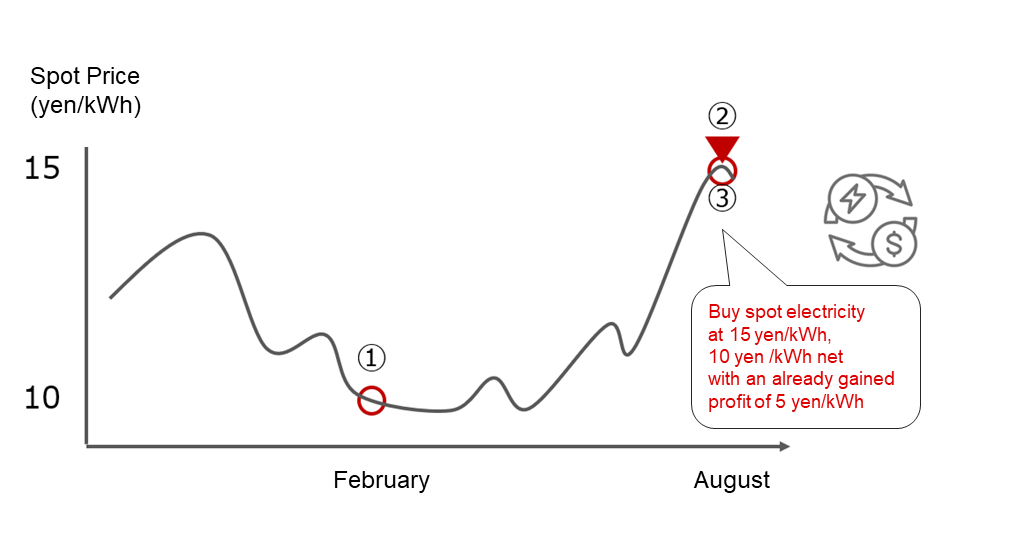

August electricity prices that buyers and sellers are speculating (Futures for August deliveries) ②

As power futures are financial transactions not involving physicals, Company A needs to buy electricity the following day at 15 yen per kWh for sales to its customers(end users). Still, it can procure electricity at 10 yen per kWh net with an already gained profit of 5 yen per kWh. In this way, futures trading serves as a hedging tool for price risk management.

August electricity prices that buyers and sellers are speculating (Futures for August deliveries) ③

Credit risk management system for futures trading

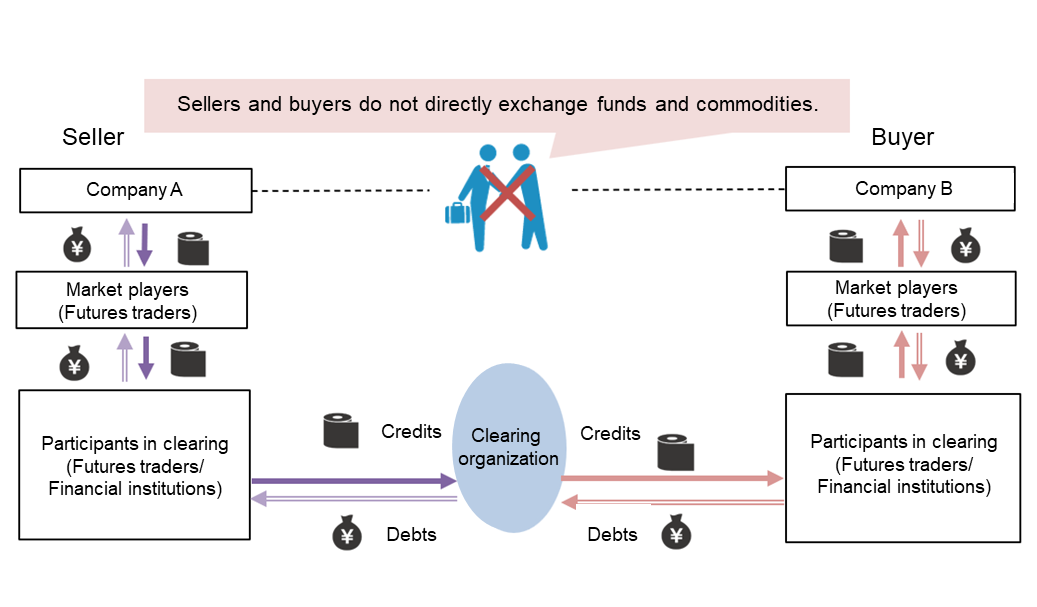

There is a possibility that a big loss may be incurred, triggering a bankruptcy due to high volatility in the electricity market. Therefore, it is vital to manage credit risks associated with the company you are dealing with. A system has been in place to ensure that power futures will be firmly executed as agreed.

A clearing organization acts as an intermediary between sellers and buyers. It assumes credits and debts from both sides and gives assurance that settlements will be done. In this way, contracting parties are free from credit risks. Excluding credit risks from futures trading is a common custom at futures exchanges internationally.

(Source) Created by METI based on the data published by Japan Securities Clearing Corporation

Potential for power futures trading

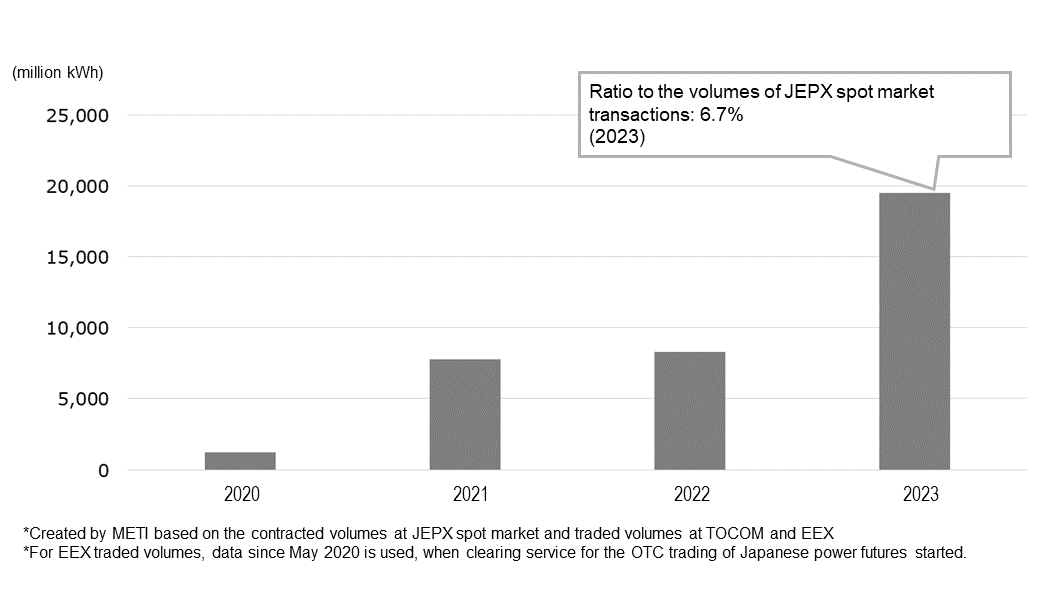

Trading volumes of power futures have been increasing steadily since the trading started in 2019. In addition to electricity businesses, various players such as financial institutions, trading houses, and foreign companies also participate, creating an environment in which contracts are easy to conclude. Recently, a number of large electricity users (for instance, businesses that have their own factories) have become interested in power futures as electricity price fluctuations may affect their profitability.

In 2023, power futures represented 7% of the volumes traded in the JEPX spot market. However, in European electricity markets, the scale of futures is estimated to be several times larger than physical volumes. It is said that Japanese futures trading has potential for further growth.

Volumes of power futures trading

Four years have passed since power futures trading started in Japan. Efforts are now required to stimulate the futures market, such as expanding the circle of participants and improving market operations to meet their expectations.

Divisions in Charge

About this article

Commodity Market Office, Commerce and Service Industry Policy Group, METI

About the Special Contents

Research and Public Relations Office, Commissioner’s Secretariat, ANRE

![]() The original Japanese text of this article; Click here

The original Japanese text of this article; Click here