Transition Finance supporting corporate efforts toward decarbonization (Part 2)

International trends and Japan’s efforts

(in provisional translation)

(English ver.) 2024-01-22

It is vitally important to decarbonize the industrial sector to achieve carbon neutrality by 2050. Transition finance is a mechanism to support steady efforts for decreasing emissions and transitioning to decarbonization based on long-term strategies to realize a carbon-neutral society. Transition finance is intended to be utilized mainly by manufacturing industries with high greenhouse gas emissions. Part 2 of this article presents ongoing discussions in the international community as well as Japan’s efforts in this initiative.

What differentiates transition finance from green finance?

Transition finance is a new financial method to provide funds to companies making steady efforts in reducing GHG emissions toward achieving decarbonization based on their long-term strategies.

There have been other methods of raising funds for decarbonization, such as green finance. What is the difference between transition finance and green finance?

Green finance provides funds to “green” companies and projects that emit little or no GHG emissions. However, high GHG emitters, such as steelmaking and cement industries, need to fundamentally change their manufacturing processes to those employing innovative decarbonization technologies. Therefore, it is difficult for them to achieve decarbonization immediately. Against this backdrop, transition finance provides funds to support high GHG emitters to become green in the future.

Transition finance attracts global attention with rulemaking efforts underway

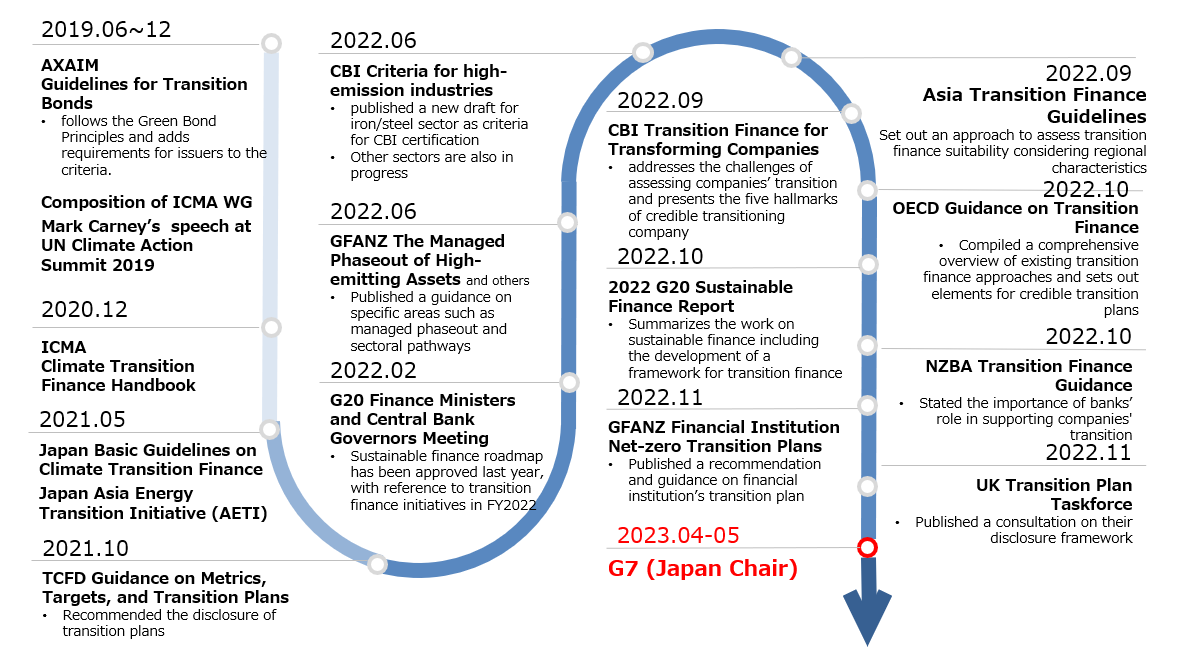

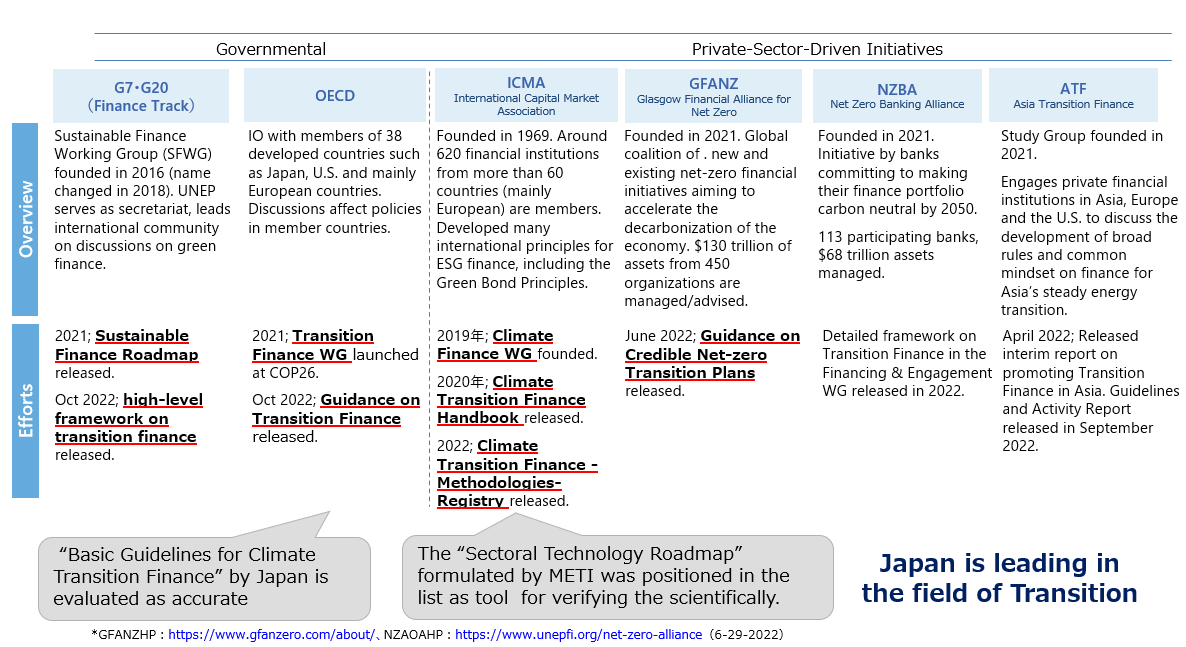

Actions to promote transition finance are gathering momentum globally. For instance, the OECD published the Guidance on Transition Finance in October 2022. The International Capital Market Association (ICMA), which has published the Green Bond Principles, a voluntary guideline for green bonds (bonds to finance efforts to solve environmental issues), published the Climate Transition Finance Handbook in December 2020, which was later revised in 2023.

International Initiatives on Transition Finance

International Trends in Transition Finance

(Source) Created by METI based on the websites of respective initiatives such as GFANZ and NZAOA (as of June 29, 2022)

The EU stipulates the EU taxonomy, which is a classification system defining criteria for green economic activities that are aligned with a net zero trajectory. However, it only offers standards to define whether a specific economic activity is green or not and may fail to assess transition efforts. Since the taxonomy is unable to classify economic activities by high GHG emitters, it has been proposed that the classification system be extended to include them.

At the G7 Ministers’ Meeting on Climate, Energy and Environment, held in Sapporo in April 2023, the communique recognized the role of transition finance.

In Japan, the GX Finance Study Group was launched to consider concrete measures for the utilization of new finance methods toward achieving GX. The study group aims to compile directions of concrete policy measures by December 2023, to promote the provision of funds by private institutions to industries toward achieving carbon neutrality by 2050.

Transition finance facing challenges of credibility and effectiveness

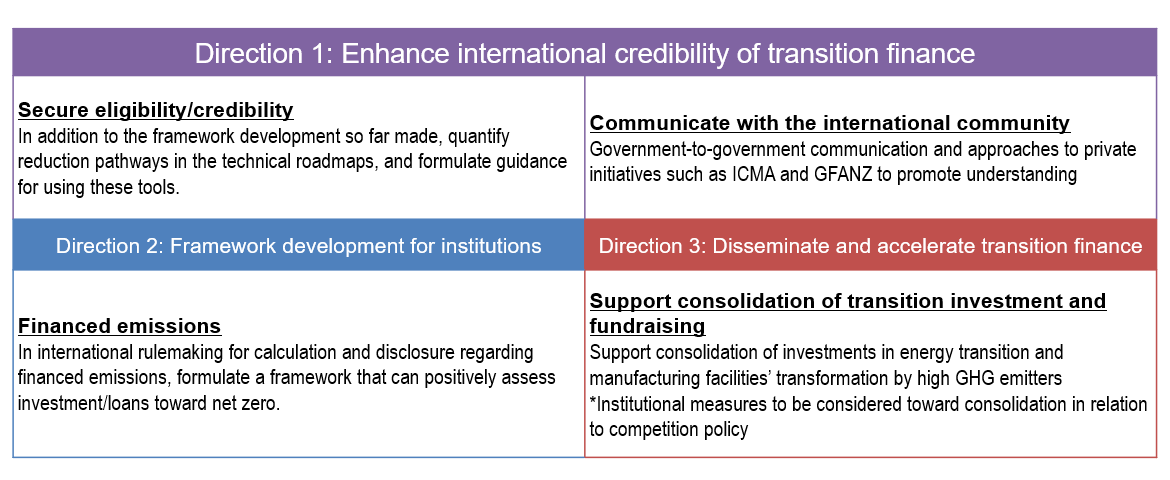

As shown above, various initiatives are advancing toward promoting the understanding of transition finance inside and outside the country through government-to-government discussions as well as in the private sector. However, these efforts have just started, and there are a number of challenges lying ahead.

To enhance credibility:

Above all, it is essential to enhance the credibility of transition finance in the international community. Transition finance refers to financing companies in transition, and therefore those companies may conduct economic activities using fossil fuels at the time of financial institutions making investment in or providing loans to them. However, there is a concern that assets related to fossil fuels may become so-called “stranded assets” exposed to devaluation due to drastic changes in society and markets at some future time. Transition finance provided to companies using fossil fuels may cause concern over future devaluation. Another issue is how to protect private institutions from “greenwashing” of the funds provided for transition. To address these challenges, it is indispensable to make efforts in securing the credibility and eligibility of transition finance.

Rulemaking for financial institutions providing transition finance:

There are also challenges on the side of financial institutions and investors. When they have provided funds to GHG emitters, they are deemed to be emitting GHG indirectly based on the proportion of their investment or loans. Financial institutions and investors are required to reduce their emissions to net zero, including indirect emissions that come from their borrowers/investees (financed emissions).

However, if they invest in or lend money to high GHG emitters in transition, they will be deemed as high GHG emitting financial institutions. On the other hand, they are expected to play an important role in supporting companies’ transition efforts to reduce emissions. To solve this complicated issue, it is necessary to create a system to positively assess investment and loans toward net zero in the international rulemaking regarding transition finance.

Assessing the eligibility of corporate transition strategies:

Furthermore, there is another challenge on the side of fund providers. It is difficult to check the progress of transition strategies of the companies to which they have provided funds, and therefore the effectiveness of transition finance may not be secured. To address this concern, the Transition Finance Follow-up Guidance was published in June 2023 as guidance for an effective dialogue with fundraisers. This guidance is formulated for financial institutions to support and promote the steady implementation of their investees/borrowers’ corporate strategies through dialogue with them.

Challenges facing transition finance and future directions

(Source) Materials distributed at the third meeting of the GX Finance Study Group

Transition finance, which is indispensable for advancing industrial decarbonization, is still in the initial stage of development. Japan will develop and establish concrete systems that are competent and credible at home and abroad.

Division in Charge

About this article

Environmental Economy Office, Industrial Science, Technology and Environmental Policy Bureau, METI

Division in charge about this article was changed to GX Finance Promotion Office as of July 4, 2023.

About Special Contents

Research and Public Relations Office, Commissioner’s Secretariat, ANRE

![]() The original Japanese text of this article; Click here

The original Japanese text of this article; Click here