Transition Finance supporting corporate efforts toward decarbonization (Part 1)

New financing method gaining attention

(in provisional translation)

(English ver.) 2024-01-05

(Source) The Basic Guidelines on Climate Transition Finance

With the movement for decarbonization accelerating globally, Japan is advancing various efforts toward achieving carbon neutrality by 2050. By the term “decarbonization,” switching fuels used for power generation to renewable energy easily comes to mind, but this is not in itself a climate change panacea; it is also vitally important to decarbonize factories and business facilities in the industrial sector. In particular, long-term efforts are needed for the manufacturing industries, which emit a large amount of greenhouse gasses through the use coal and gas in their production processes. Financing is needed to support those efforts. This article introduces transition finance, which is a novel financial approach to support companies tackling challenges toward decarbonization.

Transition finance provides funds to support long-term efforts toward decarbonization

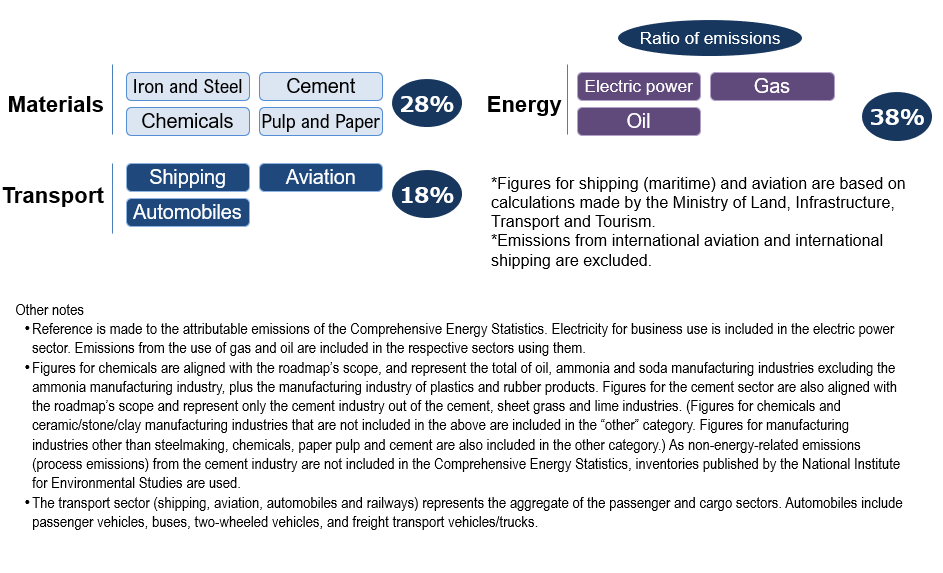

To achieve carbon neutrality by 2050, it is essential to decarbonize all sectors, including households, transport, and in particular the industry. However, some industries have difficulties in abating CO2 emissions in their manufacturing processes, and therefore will need the improvement of energy efficiency and fuel conversion, through the development and introduction of innovative technologies.

Take the steelmaking industry, for instance. At ironworks, crude steel is produced from iron ore mixed with coke (carbon) and heated at a high temperature. During this process, oxygen in the iron ore combines with carbon, generating CO2. However, this process is indispensable to produce crude steel of high purity by removing oxygen from the iron ore. Additionally, coke has the advantage of high heat efficiency. Therefore, to pursue decarbonization in this industry, a fundamental review of the overall steelmaking process will be required, including the disuse of coke, introduction of decarbonized electricity generated by renewables, and carbon capture and utilization.

At present, a number of methods are being explored, including steelmaking utilizing hydrogen, and technological development is making progress. However, these initiatives require a large sum of money and a long period of time.

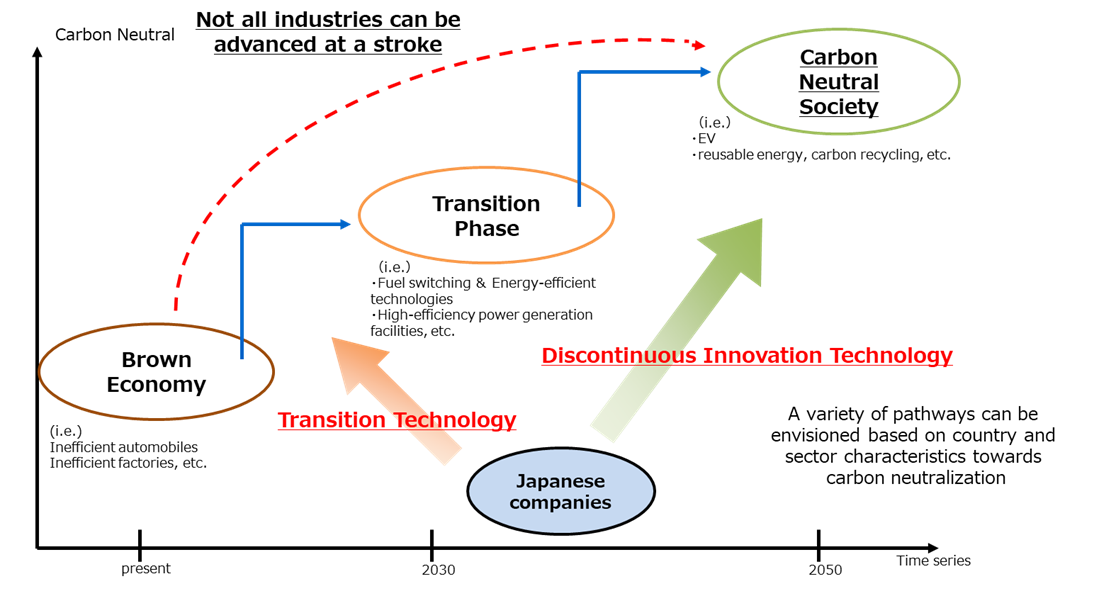

As explained above, the industrial sector faces difficulty in decarbonizing itself in one step because it needs a fundamental change in its production process. It must undertake efforts from a long-term perspective.

Under such circumstances, transition finance is attracting attention as a new financing approach that aims to support companies trying to steadily advance the transition to decarbonization. It provides uninterrupted funds to companies making efforts toward reducing GHG emissions with a long-term strategy to achieve decarbonization.

Concept of the transition to decarbonization

Japan is leading the world by proposing a concept for the transition to decarbonization and developing specific efforts.

What are the target industries and what initiatives are being taken?

Transition finance is an initiative that has just started, and rulemaking efforts are currently underway. In May 2021, METI, together with the Financial Services Agency and the Ministry of the Environment, formulated the Basic Guidelines on Climate Transition Finance as a handbook to be used domestically, aiming to establish a framework to enable the procuring of transition finance. These guidelines are based upon the Climate Transition Finance Handbook published by the International Capital Market Association (ICMA.)

Moreover, sector-specific roadmaps were also compiled for companies to enhance the credibility and transparency of transition finance. These roadmaps show pathways to carbon neutrality by 2050, which are tailored to the respective industry sectors taking into consideration their anticipated timeframes of commercializing and introducing technologies for decarbonization. These roadmaps are aligned with global trends and the Paris Agreement and can be used as a reference by companies in developing their transition strategies and by financial institutions when making financing decisions in assessing whether the borrower’s corporate strategy is credible. The guidelines have so far been formulated for eight industrial sectors, including steelmaking, chemicals, electric power, paper pulp, and cement.

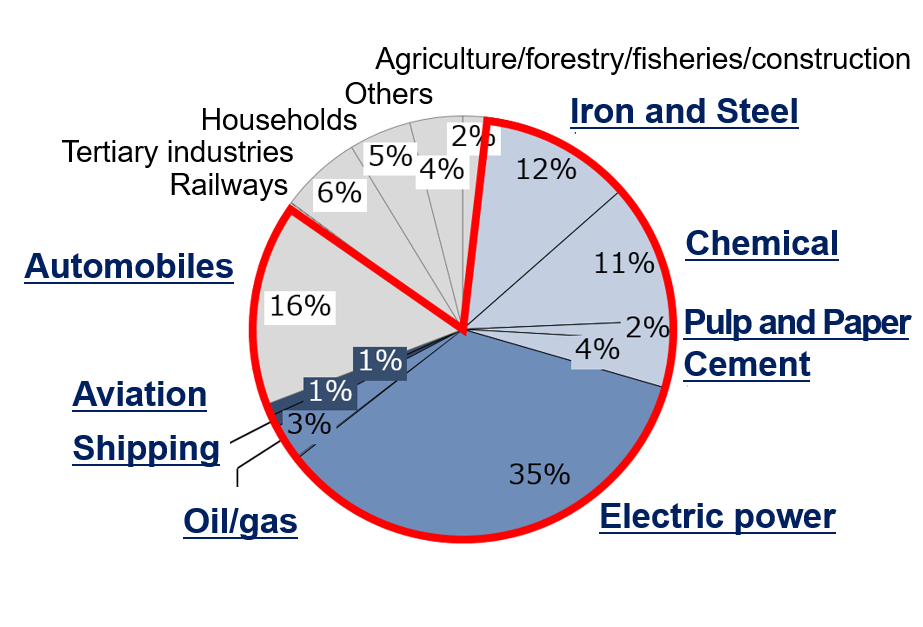

CO2 emissions by industrial sector in Japan

(Source) Created by METI based on the Comprehensive Energy Statistics of Japan and inventories published by the National Institute for Environmental Studies

Target sectors of roadmaps

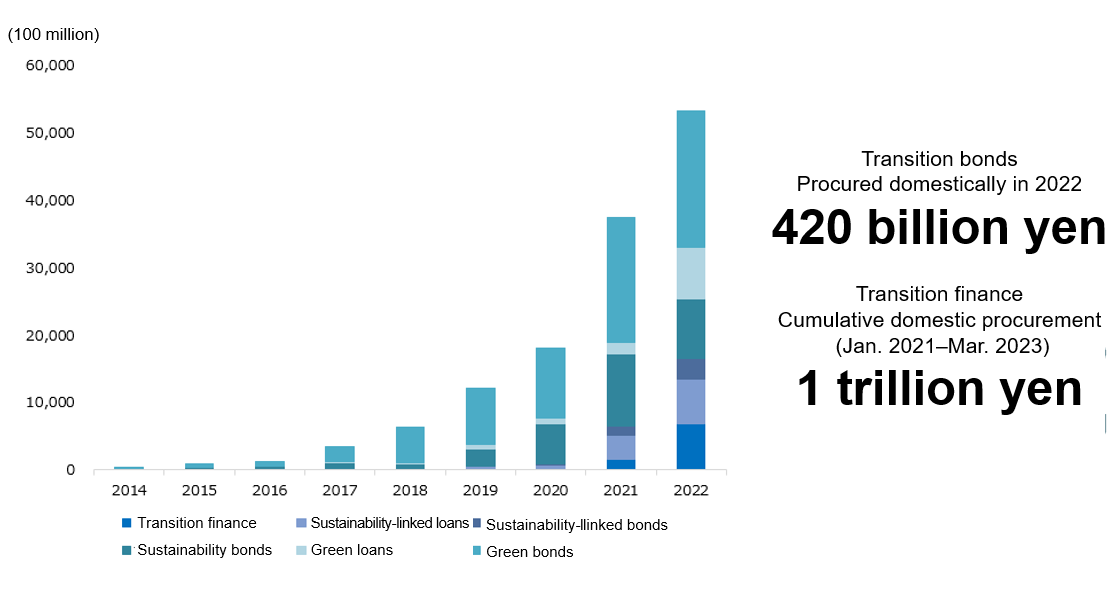

Furthermore, to trigger the dissemination of transition finance, model and subsidy projects have been selected since FY2021. Twelve model projects and nine subsidy projects have been adopted in the two years since then. With other projects included, the amount of funds raised by transition finance exceeds one trillion yen from January 2021 to March 2023 on a cumulative basis.

Funds raised for climate-related investment such as decarbonization

(Source) Created by METI based on MOE’s Green Finance Portal, METI’s transition finance and other published data

Transition finance includes undisclosed amounts that were obtained through interviews.

These efforts have attracted attention globally, leading to international discussions, such as those at the G7 Ministers’ Meeting on Climate, Energy and Environment held in Sapporo. The role of transition finance was recognized in the Ministers’ Communique.

Formulating a reliable system to prevent ”greenwashing”

Transition finance is a new system, and there are still some challenges.

There is a concern that transition finance may be deemed as “greenwashing.” To prevent this, we need to make efforts to ascertain the credibility and reliability of corporate transition strategies.

Additionally, as it involves a long-term strategy, it is important to define the length of the transition period as well as to clarify whether the strategy will definitely achieve carbon neutrality by 2050. To this end, roadmaps based on scientific grounds are necessary.

Sector-specific roadmaps that are consistent with international standards will offer a means to address those challenges. We will initiate discussions and make various efforts to promote transition finance and establish a market thereof. Part 2 of this article will present the details of ongoing discussions and international initiatives.

Division in Charge

About this article

Environmental Economy Office, Industrial Science, Technology and Environmental Policy Bureau, METI

Division in charge about this article was changed to GX Finance Promotion Office as of July 4, 2023.

About Special Contents

Research and Public Relations Office, Commissioner’s Secretariat, ANRE

![]() The original Japanese text of this article; Click here

The original Japanese text of this article; Click here