Japan’s energy policy toward achieving GX (Part 2)

Policy package toward simultaneously realizing decarbonization and economic growth

(in provisional translation)

(English ver.) 2023-06-30

The Basic Policy for the Realization of GX was compiled in December 2022, depicting a roadmap for energy and environmental policies covering the next ten years. The Basic Policy presents policies for simultaneous realization of a stable supply of energy, economic growth and decarbonization. Following Part 1 (Decarbonization will be advanced on the premise of securing a stable supply of energy,) this article highlights the policy package toward promoting transition to a decarbonized society while achieving economic growth.

What is the Basic Policy for the Realization of GX?

The Basic Policy states that the critical challenges facing us are to simultaneously realize a decarbonized society and a stable supply of energy, while realigning our economy on an upward trajectory. It is broadly divided into two parts, namely a comprehensive account of energy policy and the methodology for advancing GX.

-

【Energy policy】Advance decarbonization toward GX on the premise of securing a stable supply of energy

【Energy policy】Advance decarbonization toward GX on the premise of securing a stable supply of energy

-

【Methodology for advancing GX】A policy package to put into practice Pro-Growth Carbon Pricing Concept which is an investment promotion strategy toward simultaneously realizing economic growth and decarbonization.

【Methodology for advancing GX】A policy package to put into practice Pro-Growth Carbon Pricing Concept which is an investment promotion strategy toward simultaneously realizing economic growth and decarbonization.

Part 2 of this article highlights the growth-oriented carbon pricing scheme as a means to advance GX.

How to formulate the Pro-Growth Carbon Pricing Concept scheme and put it into practice

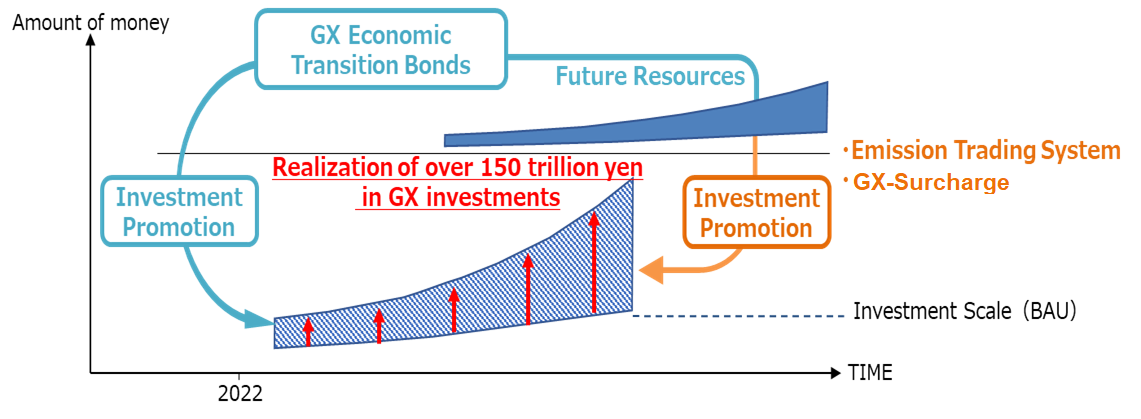

Investment is needed in a wide range of sectors toward achieving carbon neutrality by 2050 while strengthening Japan’s industrial competitiveness to bring about economic growth. The government expects the scale of such investment to be more than 150 trillion yen over the coming 10 years.

To encourage such huge GX investment through public-private collaboration, we will implement a growth-oriented carbon pricing scheme.

“Carbon pricing” refers to a policy aiming to change the behavior of carbon emitters by attaching a price to carbon. The growth-oriented carbon pricing scheme stipulated in the Basic Policy contains the following three policy measures.

- National bond issuance to support advance investment

- Emissions trading

- Carbon surcharges

As the name “growth-oriented” suggests, the scheme presents investment promotion measures which focus on both regulation and support toward the realization of economic growth.

GX Economy Transition Bonds (tentative name) to be issued for advance investment

In order to encourage large-scale investment through public-private collaboration, the government must implement support measures to boost investment by the private sector. To this end, GX Economy Transition Bonds (tentative name) will be established and utilized to provide support in the order of 20 trillion yen for advance investment by the private sector, toward ultimately realizing GX investment of more than 150 trillion yen by the public and private sectors combined.

Incentives for GX advance investment by introducing carbon pricing

The GX League, in which companies voluntarily participate, started an emissions trading system on a trial basis in April 2023. It will be implemented in a full-fledged format around FY2026. Emissions trading is a system in which companies can trade their emissions between them. In this system, companies that have failed to reduce their emissions to meet their targets will be permitted to purchase emission allowances from other companies that have reduced their emissions below their target levels.

In addition to the above, an emission allowance auction system will be introduced gradually for power generating businesses to advance decarbonization of power sources. It mandates that power generating businesses procure emission allowances based on their actual emissions, which will be purchased through auction. In introducing the auction system, the ratio of emission allowances to be auctioned will be increased gradually. The system is expected to start around FY2033.

Moreover, a surcharge will be introduced on importers of fossil fuels such as oil and coal in proportion to their carbon emissions around FY2028. The surcharge will start with a low level that will gradually increase.

Utilizing new financial measures

Toward realizing large-scale GX investment, it is necessary to attract ESG investment* from home and abroad through private banks and institutional investors, in addition to government support through GX Economy Transition Bonds (tentative name).

*ESG investment: Investment in enterprises which consider the environment, society, and governance in their corporate activities

Therefore, we will develop domestic markets for green finance (specializing in environmentally friendly projects) and enhance our efforts toward deepening international understanding of transition finance.*

*Transition finance: Investments and loans to transform hard-to-abate business activities to decarbonized ones

In the GX sector, there are some projects that are quite unpredictable in terms of technologies and demand for their products. In such cases, private financing alone cannot take risks, and knowledge must be integrated by the public and private sectors toward establishing a financing method referred to as “blended finance” to combine public and private funds.

*****

As outlined above, the Basic Policy presents measures and concrete timeframes for promoting GX investment in addition to future directions of Japan’s energy policy. Furthermore, roadmaps in the respective industrial fields are shown with the sizes of new markets to be created by GX investment and their effects on emission reduction.

Division in charge

About the article

Policy Planning and Coordination Division, Commissioner’s Secretariat, ANRE

Environmental Policy Division, Industrial Science, Technology and Environment Policy Bureau, METI

About Special Contents

Research and Public Relations Office, Commissioner’s Secretariat, ANRE

![]() The original Japanese text of this article; Click here

The original Japanese text of this article; Click here