Japan’s New International Resource Strategy for Enhancing LNG Security

(in provisional translation)

(English ver.) 2021-01-06

This series of articles presents Japan’s new “international resource strategy” established in March, 2020. Japan’s basic energy policy, referred to as “3E + S”, aims to simultaneously achieve Energy security, Economic efficiency and Environmental suitability with the underlying premise that Safety is always the primary concern. What measures is Japan taking based on this new strategy while maintaining its 3E+S policy? Following the first article which highlighted measures to enhance the stability of the oil supply, this article will focus on Japan’s strategy regarding liquefied natural gas (LNG).

Diversification of supply sources for a stable supply of LNG

Liquefied natural gas (LNG) plays an increasingly important role as a cleaner source of energy with less greenhouse gas (GHG) emissions. It is considered to be one of the most important energy sources for Japan, accounting for approximately 23% of its primary energy supply. Unlike oil, LNG is difficult to hold in stock for a long time. Therefore, Japan should prepare for emergency situations to ensure that a continuous supply of LNG can be secured.

The new resource strategy underlined efforts to diversify supply sources for a stable supply of LNG.

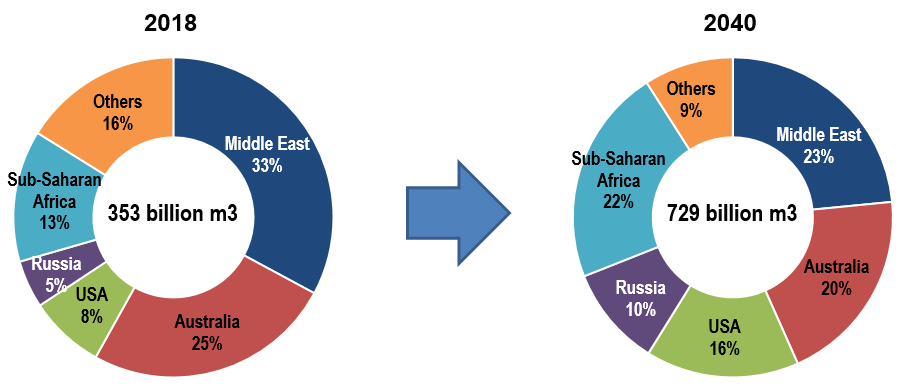

More than half of the global supply of LNG currently depends on the Middle East and Australia as shown below. However, diversification will proceed with the USA, Russia and Africa advancing development and liquefaction projects.

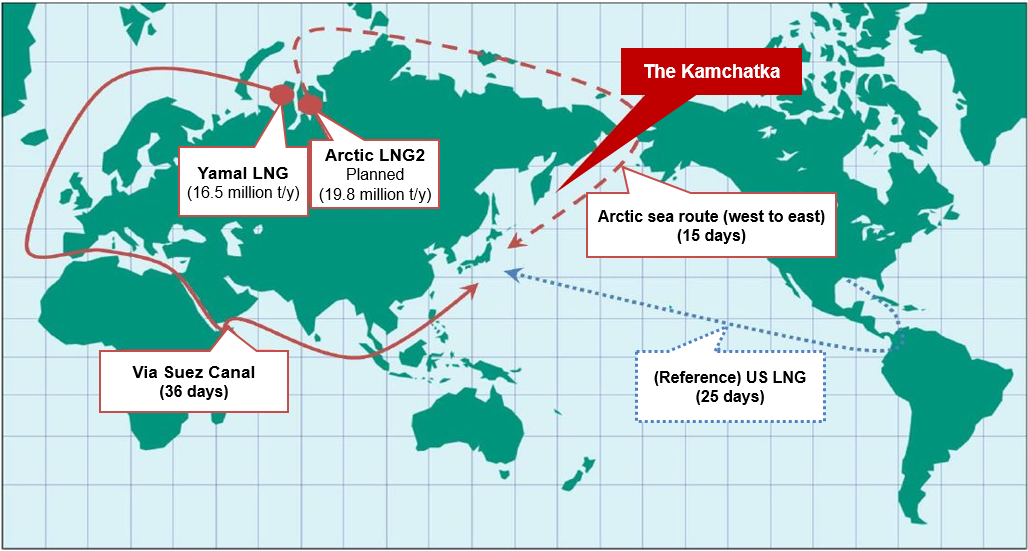

It is expected that supply from Russia to LNG consumer countries will increase. Russia, with plentiful resources in the Arctic, is located closer to Japan than other producers, with advantages such as fewer days required for transportation compared with the Middle East and North America. It is considered necessary to support Japanese companies so that they can actively participate in development projects in the Arctic.

The Arctic Ocean is covered by thick sea ice, and therefore building “trans-shipment terminals” is of crucial importance for a stable supply to Japan. LNG produced in the Arctic will be transported via LNG icebreaker tankers. Temporarily storing the LNG at facilities in a trans-shipment terminal, for example at the Kamchatka, for trans-shipment onto a conventional LNG carriers to various destinations, can reduce transportation costs. Furthermore, involvement by Japanese companies in projects for building trans-shipment terminals will bring about new business opportunities taking advantage of such terminals as LNG distribution hubs.

The Japan Oil, Gas and Metals National Corporation (JOGMEC) has been supporting Japanese companies by making direct investments or providing debt guarantee for gas field development and liquefaction projects. Moreover, following the new strategy, a revision was made to the JOGMEC Act (the Act on the Japan Oil, Gas and Metals National Corporation, Independent Administrative Agency) which enables JOGMEC to directly invest or provide debt guarantee to Japanese companies participating in projects for building and operating LNG trans-shipment terminals.

LNG projects in the Arctic and sea routes

(Source) Directions of the New International Resource Strategy

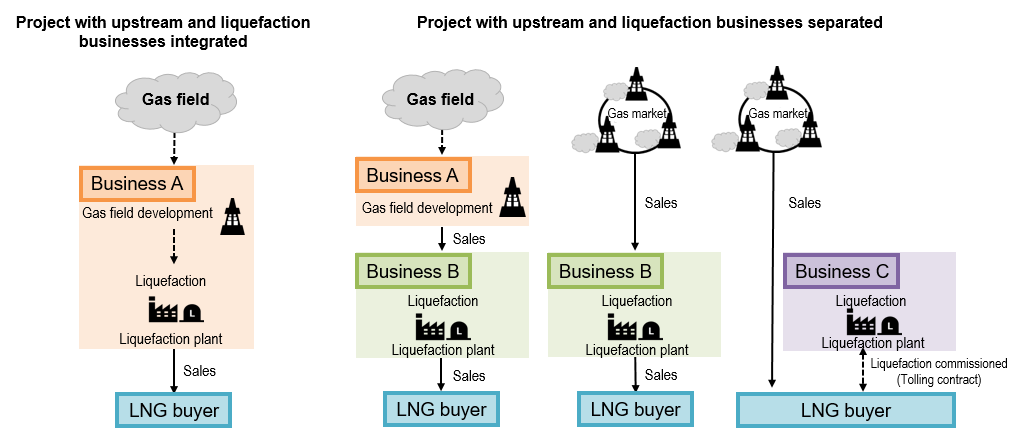

New business models are emerging in line with the expansion of LNG markets. In most conventional LNG projects, gas is produced where the gas field is developed, and then liquefied in its vicinity for LNG shipment. However, there is an increasing number of new projects where gas field developers and gas liquefaction businesses are operating independently. In this new business model, gas is produced from the gas field and then transported for a long distance via pipeline to liquefaction plants that are operated by different entities. Efforts will be made to support Japanese companies in response to changing business models so that they can participate in such projects.

(Source) Points to be discussed toward establishing the new international resource strategy

Creating markets that integrate strong Asian demand

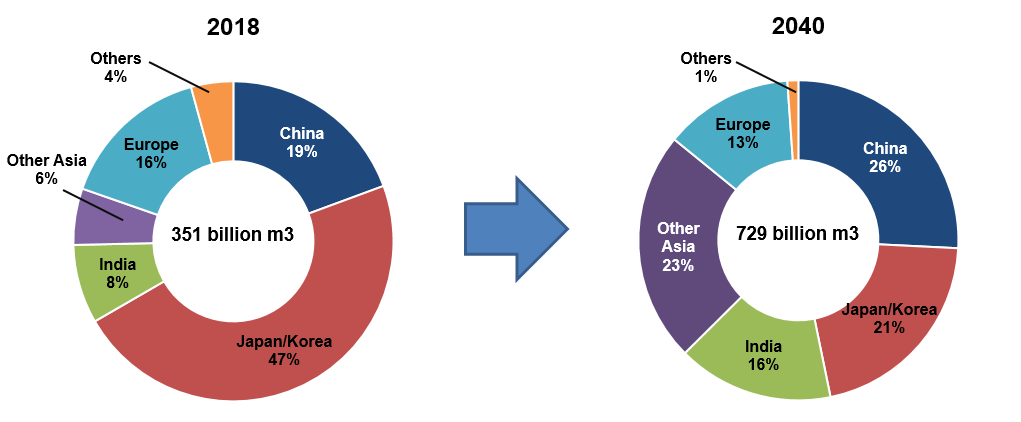

Global LNG demand is expected to double by 2040 with the emergence of fast-growing LNG importers. In 2018, Japan and Korea accounted for 47% of net imports. In 2040, China, India and other Asian nations will contribute to market growth with the ratio of Japan decreasing substantially.

Japan will need to maintain its influence in the market to be able to secure a stable supply of LNG. To this end, Japan should play a leading role in creating a larger international market that integrates strong Asian demand. The new international resource strategy stipulates the following measures that Japan should take.

Increasing trade with third countries

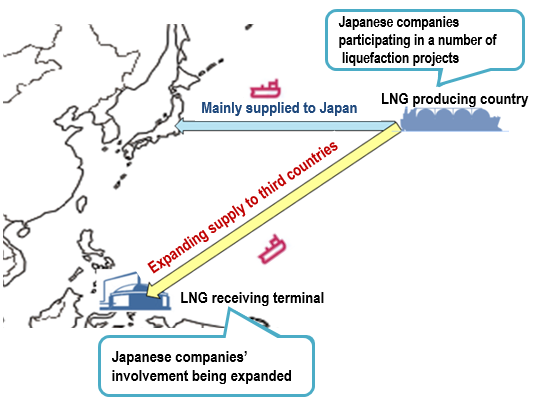

JOGMEC has been supporting Japanese companies by making direct investments or providing debt guarantee for gas field development and liquefaction projects, in which Japanese companies participate to obtain the supply of LNG for Japan. Additionally, JOGMEC, looking at the overall LNG value chain from production to receiving, will enable Japanese companies to be involved in LNG trade with third countries. For instance, Japanese companies may play a leading role in a project for delivering LNG produced in the USA to countries of South East Asia or South Asia.

A revision was made to the JOGMEC Act to enables JOGMEC to make direct investments or provide debt guarantee to Japanese companies participating in projects that are building and operating LNG receiving terminals in third countries.

Promoting LNG trade with third countries

(Source) Directions of the New International Resource Strategy

Setting a target of 100 million tons per year of LNG to be handled by Japanese companies

In order to further expand the Asian LNG market, Japan should utilize its 50 years of knowledge and experience in importing LNG and cultivate Asian demand by constructing new LNG-fired power stations, etc., which will encourage new projects to be commissioned on the supply side. To this end, the new strategy set a target of 100 million tons per year of LNG to be handled by Japanese companies including trade with third countries by FY2030. Japan aims to play a leading role as a major LNG buyer in the global market.

Fostering human resources

JOGMEC and other organizations which intend to cooperate with Asian countries in relation to LNG will jointly hold a “Conference of LNG Human Resources Training Organizations” with the government acting as intermediary. Workshops and other events will take place in collaboration with other countries such as the USA.

Making efforts to remove the destination clause from LNG contracts

Removing the destination clause, which is stipulated in conventional LNG contracts, is a critical challenge facing Japan in terms of its ability to maintain or increase the amount of LNG it can handle in the future. The majority of LNG sales contracts contain the “destination clause” which specifies the unloading terminals for LNG carriers. This clause makes it difficult for buyers to adjust supply and demand by reselling LNG, and creates inflexibility in LNG trade.

In order to rectify this situation, discussions have been held between LNG producing countries and consuming countries toward the relaxation or removal of the destination clause. Government-level discussions will continue to be held in cooperation with other countries and regions such as the EU to promote understanding in Asia and advance collaboration among LNG-consuming nations.

Division in charge

About the article

Policy Planning Division, Natural Resources and Fuel Department

About Special Contents

Research and Public Relations Office, Policy Planning and Coordination Division, Commissioner's Secretariat

![]() The original Japanese text of this article; Click here

The original Japanese text of this article; Click here