Japan’s new international resource strategy to secure rare metals

(in provisional translation)

(English ver.) 2020-09-30

Rare earth smelting works (picture provided by Lynas Corporation Ltd.)

Japan’s basic energy policy is to simultaneously achieve Energy security, Economic efficiency and Environmental suitability with the underlying premise that Safety is always the primary concern (3E + S). This article highlights its strategy toward securing a precious mineral resource known as “rare metals”.

Rare metals plays an increasingly important role

Mineral resources, rare metals in particular, are essential to the production of lithium-ion batteries, motors and semiconductors for leading-edge industries related to electrified vehicles (xEVs), AI-mounted equipment and IoT devices. Rare metals are produced in limited quantities, and some of them are extracted from raw materials with technical difficulties while the demand for rare metals is expected to increase in Japan.

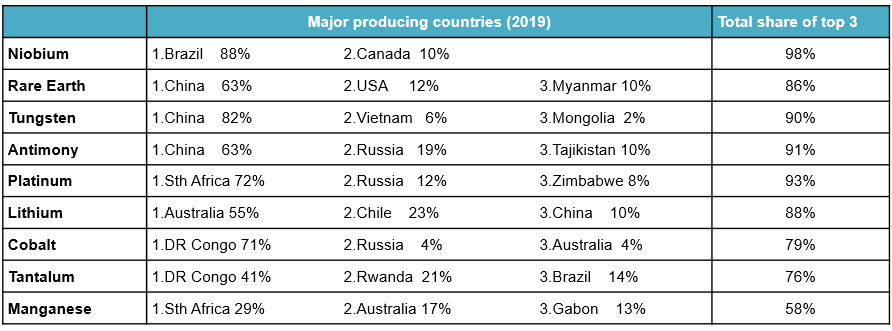

Japan depends on imports from overseas for most of its demand for rare metals. However, uncertainties exist on the supply side. There are 34 kinds of rare metals, each of which is produced by a limited number of countries having large market shares as shown in the following table. Furthermore, many rare metals are produced in countries that are politically unstable.

Unevenness of rare metal producing countries

(Source) Mineral Commodity Summaries 2020

The markets for rare metals are relatively small compared to those for base metals such as iron and aluminum that are produced in large quantities. Due to the small market size, rare metals tend to be vulnerable to price volatility. Additionally, rare metals are produced as by-products of other minerals. Therefore, the supply of primary products tends to affect the supply of rare metals. In addition to these characteristics inherent to rare metals, the demand for some rare metals is expected to exceed the supply in the future, which may lead to increased competition between Europe, the USA, China and emerging economies toward securing resources.

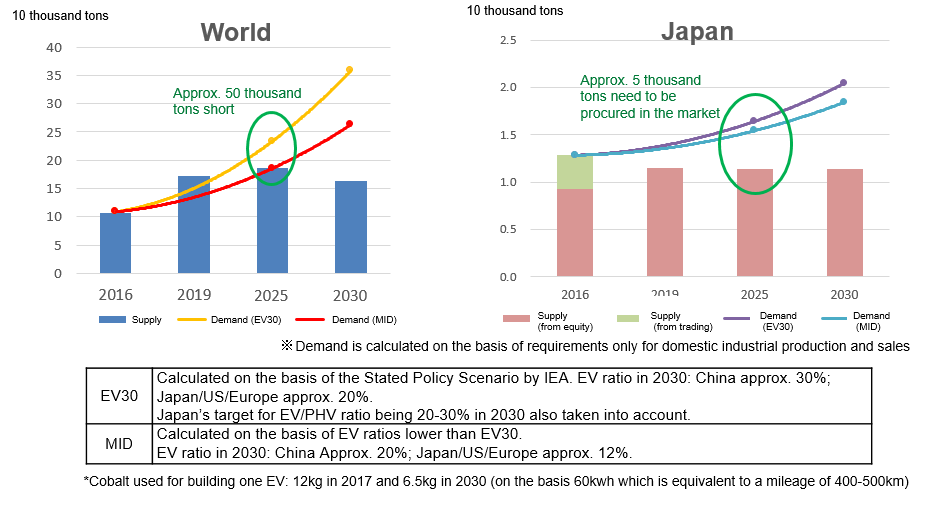

Forecast of Supply/Demand Imbalance for Cobalt

(Source) Created by the Agency for Natural Resources and Energy based on materials published by Wood Mackenzie and the International Energy Agency

Japan’s new international resource strategy includes efforts described below toward securing a stable supply of mineral resources in the future.

Strategic approaches to be formulated for respective mineral resources

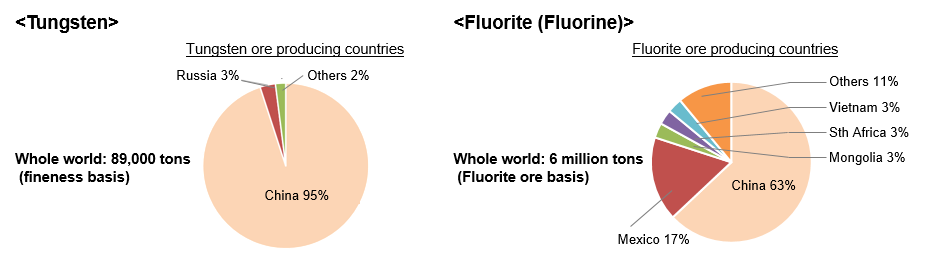

As mentioned before, rare metal producing countries are not diverse. The market size, price and major producing countries are different for each kind of rare metals. For instance, cobalt, which is used for lithium-ion batteries, is mainly produced in the Democratic Republic of the Congo having a dominant production share of 64%. Tungsten, which is essential to special steel production, is dominated by China with an overwhelming production share of 90%+. Fluorite, which is used for lithium-ion battery production and semiconductor processing, is also dominated by China with a large share of 60%+. As these examples show, a limited number of countries dominate the production of rare metals.

(Source) Created by the Agency for Natural Resources and Energy based on USGS, World Metal Yearbook 2018, MOF Trade Statistics and JOGMEC Mineral Resources Material Flow 2018.

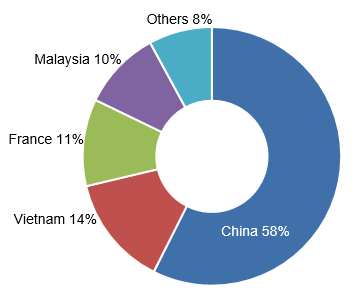

Furthermore, the demand for rare earth (a kind of rare metal, comprised of a group of 17 metal elements) is expected to increase along with the dissemination of xEVs. Japan imports approximately 60% of its requirements for rare earth from China. If emergencies such as the spread of an infectious disease occur in major producing countries, there may be supply disruptions.

Japan’s dependency on China for the supply of rare earth (2018)

(Source) Created by the Agency for Natural Resources and Energy based on the Trade Statistics published by the Ministry of Finance

The new strategy aims to work out strategic approaches toward securing resources by assessing risks associated with each kind of resources and selecting policies on which emphasis is to be placed. In doing so, factors such as the uneven distribution of resources, risks associated with respective producing countries, and supply/demand forecasts are to be analyzed.

Diversification of supply sources

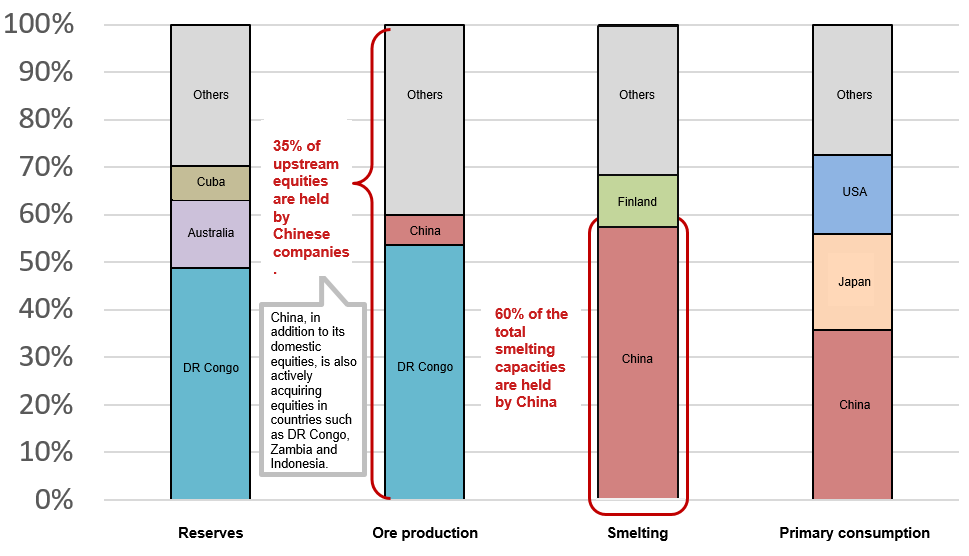

In order to secure a stable supply of mineral resources, the acquisition of upstream equities is of vital importance. In the past, mining sites and smelting works are usually located close to each other. However, in recent years, there are an increasing number of projects solely for the smelting process, with smelting taking place away from the mining site. In this new business model, ore is transported from the mine to the smelting location, and the equity of this smelting process is, in many cases, owned by a particular country, for example, China. If an emergency occurs in that country, there may be interruptions of supply.

China’s dominance in the smelting process of Cobalt

(Source) Created based on the report (the “Exploration business for the Promotion of Mineral Resource Development) commissioned in FY2017 by the Agency for Natural Resources and Energy

The Japan Oil, Gas and Metals National Corporation (JOGMEC) has been supporting projects for mineral resource development. From now on, JOGMEC, from the viewpoint of risk management, will also support Japanese companies participating in business models for building smelting works alone as well as projects that have shifted from the exploration stage (to explore the underground reserves) to the development stage.

In order to add flexibility to these support programs, procedures of examining applications for loan guarantees by JOGMEC will be streamlined with strictness in assessment of the projects and management thereof maintained.

Emergency reserves to be enhanced for added security

As in the case with oil, emergency reserves of rare metals are kept domestically. As for the 34 rare metals, stocks are being built depending upon the political situations of the producing countries, Japan’s dependency ratios and requirements. Through public-private cooperation, stocks are currently kept with a target of 60 days (30 days for some metals) of standard domestic consumption. However, it was back in 1986 at the Mining Industry Committee that this target was established. Therefore, it has been decided that the target be reviewed upward to respond to emerging risks associated with changing industrial structures, increasing importance of rare metals, overwhelming dominance of China, and other factors.

The target has so far been set with private and public stocks combined. In the future, public stockpiling alone will be used for setting the target. Furthermore, the target will be set in a flexible manner. For metals and items with high risks such as political instability of producing countries, a higher number of days will be set as a target while, on the other hand, for those with a stable supply expected, a lower number of days may be employed.

The industrial base to be reinforced by promoting international cooperation toward the enhancement of supply chains

As the supply chains of mineral resources are expanding globally, risks threatening a stable supply of rare metals have become far greater than before. METI will strive to strengthen international cooperation, through JOGMEC, with countries that are involved in various stages of the supply chain, such as mine development, smelting and product manufacturing.

Besides, since many rare metals are produced as by-products of base metals, it is also important to strengthen the industrial and technological infrastructures supporting the production of base metals.

Efforts are also to be made through the industry-academia-government collaboration to address various challenges including technological development and securing human resources.

Division in charge

About the article

Policy Planning Division, Natural Resources and Fuel Department

About Special Contents

Research and Public Relations Office, Policy Planning and Coordination Division, Commissionerʼs Secretariat

![]() The original Japanese text of this article; Click here

The original Japanese text of this article; Click here